Introduction

Cipher stands apart from most backtesting frameworks by focusing on position adjustments within the scope of individual trading sessions.

Core Concepts

Cipher uses distinctive terminology that reflects its session-based approach:

buy→add to positionsell→reduce positiontrade→session(trading session)close trade→close session(achieved by adjusting position to 0)market order→transaction(executed when position changes)limit/stop orders→brackets

Key Features

- Clean Architecture: Well-structured, intuitive, and easily extensible

- Concurrent Sessions: Support for multiple simultaneous trading sessions

- Advanced Exit Strategies: Implement sophisticated strategies like trailing take profits

- Multi-Source Data: Support for multiple exchanges, symbols, and timeframes

- Modular Design: Signal generation and handling are cleanly separated

- Simple Execution: Run strategies with just

python my_strategy.py - Cloud Ready: Compatible with Google Colab

- Flexible Visualization: Built-in support for finplot and mplfinance

Note: Cipher is designed exclusively for backtesting and does not support forward testing, paper trading, or live trading.

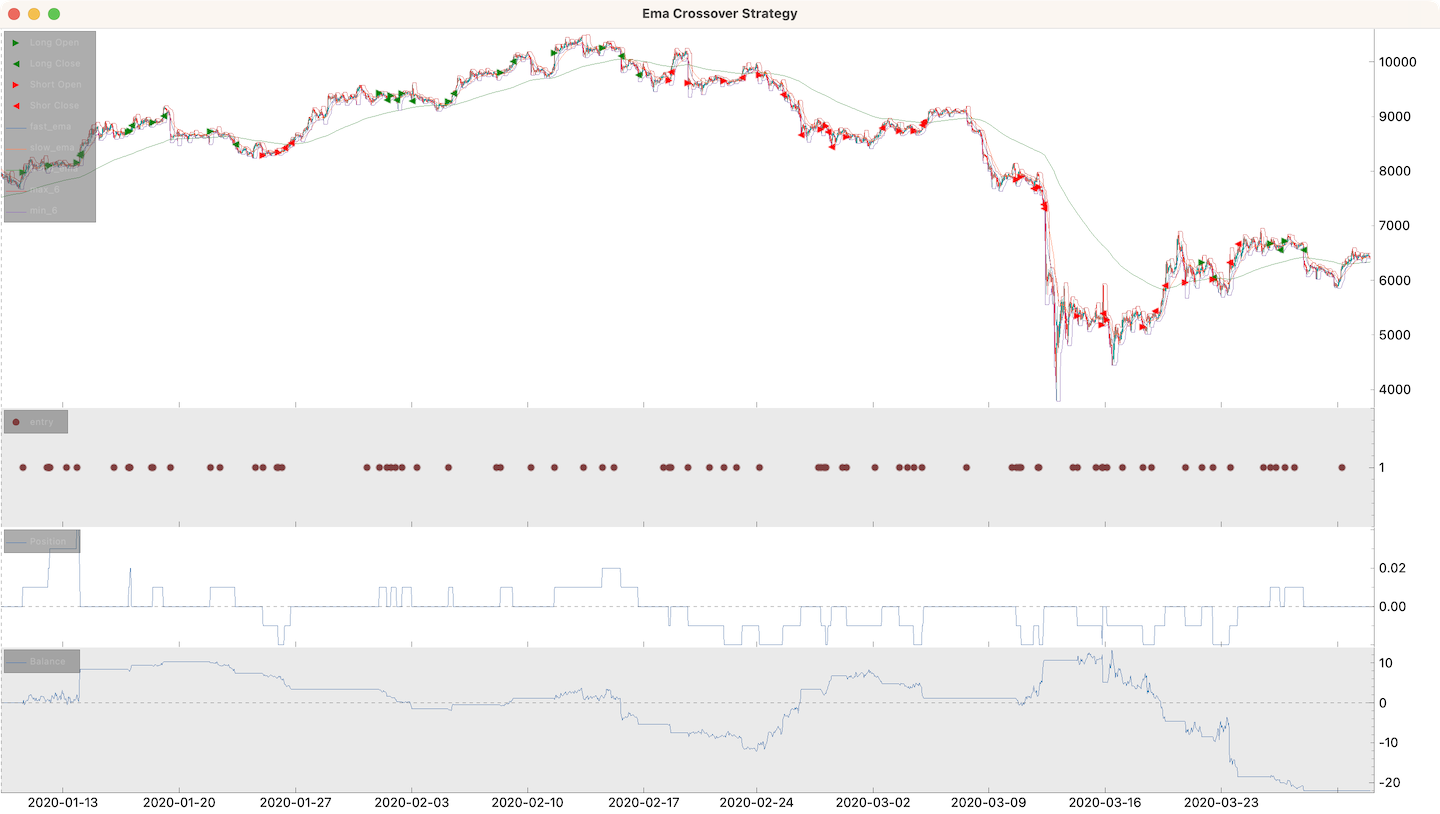

Example Strategy

Here's an EMA crossover strategy implementation:

import numpy as np

import talib

from cipher import Cipher, Session, Strategy

class EmaCrossoverStrategy(Strategy):

def __init__(self, fast_ema_length=9, slow_ema_length=21, trend_ema_length=200):

self.fast_ema_length = fast_ema_length

self.slow_ema_length = slow_ema_length

self.trend_ema_length = trend_ema_length

def compose(self):

df = self.datas.df

# Calculate EMAs using talib

df["fast_ema"] = talib.EMA(df["close"], timeperiod=self.fast_ema_length)

df["slow_ema"] = talib.EMA(df["close"], timeperiod=self.slow_ema_length)

df["trend_ema"] = talib.EMA(df["close"], timeperiod=self.trend_ema_length)

# Calculate crossover signal

df["difference"] = df["fast_ema"] - df["slow_ema"]

# Signal columns must be boolean type

df["entry"] = np.sign(df["difference"].shift(1)) != np.sign(df["difference"])

# Calculate support and resistance levels using talib

df["max_6"] = talib.MAX(df["high"], timeperiod=6)

df["min_6"] = talib.MIN(df["low"], timeperiod=6)

return df

def on_entry(self, row: dict, session: Session):

# Long position: bullish crossover above trend

if row["difference"] > 0 and row["close"] > row["trend_ema"]:

session.position += "0.01"

session.stop_loss = row["min_6"]

session.take_profit = row["close"] + 1.5 * (row["close"] - row["min_6"])

# Short position: bearish crossover below trend

elif row["difference"] < 0 and row["close"] < row["trend_ema"]:

session.position -= "0.01"

session.stop_loss = row["max_6"]

session.take_profit = row["close"] - 1.5 * (row["max_6"] - row["close"])

# Optional: Custom signal handlers

# def on_<signal>(self, row: dict, session: Session) -> None:

# """Custom signal handler called for each open session.

# Use this to adjust positions or modify brackets."""

#

# # Position adjustment examples:

# # session.position = 1 # Set absolute position

# # session.position = base(1) # Same as above

# # session.position = '1' # Auto-converts to Decimal

# # session.position = quote(100) # Set position worth 100 quote units

# # session.position += 1 # Add to position

# # session.position -= Decimal('1.25') # Reduce position

# # session.position += percent(50) # Increase by 50%

# # session.position *= 1.5 # Same as percent(50)

# pass

# def on_take_profit(self, row: dict, session: Session) -> None:

# """Called when take profit is hit. Default: closes position.

# Override to adjust position/brackets and continue session."""

# session.position = 0

# def on_stop_loss(self, row: dict, session: Session) -> None:

# """Called when stop loss is hit. Default: closes position.

# Override to adjust position/brackets and continue session."""

# session.position = 0

# def on_stop(self, row: dict, session: Session) -> None:

# """Called when dataframe ends with open sessions.

# Use this to close positions, otherwise they're ignored."""

# session.position = 0

def main():

# Initialize and configure Cipher

cipher = Cipher()

cipher.add_source("binance_spot_ohlc", symbol="BTCUSDT", interval="1h")

cipher.set_strategy(EmaCrossoverStrategy())

cipher.set_commission("0.00075")

# Run backtest

cipher.run(start_ts="2020-01-01", stop_ts="2020-04-01")

# Display results

print(cipher.sessions)

print(cipher.stats)

cipher.plot()

if __name__ == "__main__":

main()

Risk Disclaimer

This software is intended for educational purposes only. Never risk capital you cannot afford to lose.

USE THIS SOFTWARE AT YOUR OWN RISK. The authors and affiliates assume no responsibility for trading results or financial losses incurred through the use of this software.