VuManChu Cipher B

Here we will extract indicators from a TradingView pine script, use them to build a strategy, and optimize the strategy parameters.

The strategy was found here:

Indicators

The waves from VuManChu Cipher B in pine look similar to:

chlen = 9

avg = 12

malen = 3

esa = ema(hlc3, chlen)

de = ema(abs(hlc3 - esa), chlen)

ci = (hlc3 - esa) / (0.015 * de)

wt1 = ema(ci, avg)

wt2 = sma(wt1, malen)

Using the same idea when composing the pandas dataframe:

import talib

from cipher import Cipher, Strategy

class VuManChuCipherBStrategy(Strategy):

def __init__(

self,

wave_channel_length=9,

wave_average_length=12,

wave_ma_length=3,

wave_k=0.015,

mfi_length=60,

slow_ema_length=200,

fast_ema_length=50,

):

self.wave_channel_length = wave_channel_length

self.wave_average_length = wave_average_length

self.wave_ma_length = wave_ma_length

self.wave_k = wave_k

self.mfi_length = mfi_length

self.slow_ema_length = slow_ema_length

self.fast_ema_length = fast_ema_length

def compose(self):

df = self.datas.df

hlc3 = (df["high"] + df["low"] + df["close"]) / 3

esa = talib.EMA(hlc3, timeperiod=self.wave_channel_length)

de = talib.EMA(abs(hlc3 - esa), timeperiod=self.wave_channel_length)

ci = (hlc3 - esa) / (de * self.wave_k)

df["wt1"] = talib.EMA(ci, timeperiod=self.wave_average_length)

df["wt2"] = talib.SMA(df["wt1"], timeperiod=self.wave_ma_length)

df["mfi"] = talib.stream_MFI(

high=df["high"],

low=df["low"],

close=df["close"],

volume=df["volume"],

timeperiod=self.mfi_length,

)

df["fast_ema"] = talib.EMA(df["close"], timeperiod=self.fast_ema_length)

df["slow_ema"] = talib.EMA(df["close"], timeperiod=self.slow_ema_length)

return df

def main():

cipher = Cipher()

cipher.add_source("gateio_spot_ohlc", symbol="DOGE_USDT", interval="1h")

cipher.set_strategy(VuManChuCipherBStrategy())

cipher.run(start_ts="2025-01-01", stop_ts="2025-04-01")

cipher.plot(

rows=[

["ohlc", "slow_ema", "fast_ema"],

["wt1", "wt2"],

["mfi"],

]

)

if __name__ == "__main__":

main()

Signals

Enter long:

- close > slow_ema

- low < fast_ema

- mfi > 0

- wt1 < 0

- wt1 cross wt2 from below

Enter short:

- close < slow_ema

- low > fast_ema

- mfi < 0

- wt1 > 0

- wt1 cross wt2 from above

import numpy as np

import talib

from cipher import Cipher, Strategy

class VuManChuCipherBStrategy(Strategy):

def __init__(

self,

wave_channel_length=9,

wave_average_length=12,

wave_ma_length=3,

wave_k=0.015,

mfi_length=60,

atr_length=24,

slow_ema_length=200,

fast_ema_length=50,

):

self.wave_channel_length = wave_channel_length

self.wave_average_length = wave_average_length

self.wave_ma_length = wave_ma_length

self.wave_k = wave_k

self.mfi_length = mfi_length

self.atr_length = atr_length

self.slow_ema_length = slow_ema_length

self.fast_ema_length = fast_ema_length

def compose(self):

df = self.datas.df

hlc3 = (df["high"] + df["low"] + df["close"]) / 3

esa = talib.EMA(hlc3, timeperiod=self.wave_channel_length)

de = talib.EMA(abs(hlc3 - esa), timeperiod=self.wave_channel_length)

ci = (hlc3 - esa) / (de * self.wave_k)

df["wt1"] = talib.EMA(ci, timeperiod=self.wave_average_length)

df["wt2"] = talib.SMA(df["wt1"], timeperiod=self.wave_ma_length)

df["mfi"] = (

talib.stream_MFI(

high=df["high"],

low=df["low"],

close=df["close"],

volume=df["volume"],

timeperiod=self.mfi_length,

)

- 50

)

df["atr"] = talib.ATR(

high=df["high"],

low=df["low"],

close=df["close"],

timeperiod=self.atr_length,

)

df["fast_ema"] = talib.EMA(df["close"], timeperiod=self.fast_ema_length)

df["slow_ema"] = talib.EMA(df["close"], timeperiod=self.slow_ema_length)

difference = df["wt2"] - df["wt1"]

cross = np.sign(difference.shift(1)) != np.sign(difference)

df["long_entry"] = (

(df["close"] > df["slow_ema"])

& (df["low"] < df["fast_ema"])

& (df["mfi"] > 0)

& (df["wt1"] < 0)

& cross

& (difference < 0)

)

df["short_entry"] = (

(df["close"] < df["slow_ema"])

& (df["low"] > df["fast_ema"])

& (df["mfi"] < 0)

& (df["wt1"] > 0)

& cross

& (difference > 0)

)

df["entry"] = df["long_entry"] | df["short_entry"]

return df

def main():

cipher = Cipher()

cipher.add_source("gateio_spot_ohlc", symbol="DOGE_USDT", interval="1h")

cipher.set_strategy(VuManChuCipherBStrategy())

cipher.run(start_ts="2025-01-01", stop_ts="2025-04-01")

cipher.plot(

rows=[

["ohlc", "slow_ema", "fast_ema"],

["signals"],

["wt1", "wt2"],

["mfi"],

]

)

if __name__ == "__main__":

main()

Position

Take profit = 2x stop loss.

import numpy as np

import talib

from cipher import Cipher, Session, Strategy, quote

class VuManChuCipherBStrategy(Strategy):

def __init__(

self,

wave_channel_length=9,

wave_average_length=12,

wave_ma_length=3,

wave_k=0.015,

mfi_length=60,

atr_length=24,

stop_loss_k=2,

take_profit_k=4,

slow_ema_length=200,

fast_ema_length=50,

):

self.wave_channel_length = wave_channel_length

self.wave_average_length = wave_average_length

self.wave_ma_length = wave_ma_length

self.wave_k = wave_k

self.mfi_length = mfi_length

self.atr_length = atr_length

self.stop_loss_k = stop_loss_k

self.take_profit_k = take_profit_k

self.slow_ema_length = slow_ema_length

self.fast_ema_length = fast_ema_length

def compose(self):

df = self.datas.df

hlc3 = (df["high"] + df["low"] + df["close"]) / 3

esa = talib.EMA(hlc3, timeperiod=self.wave_channel_length)

de = talib.EMA(abs(hlc3 - esa), timeperiod=self.wave_channel_length)

ci = (hlc3 - esa) / (de * self.wave_k)

df["wt1"] = talib.EMA(ci, timeperiod=self.wave_average_length)

df["wt2"] = talib.SMA(df["wt1"], timeperiod=self.wave_ma_length)

df["mfi"] = (

talib.stream_MFI(

high=df["high"],

low=df["low"],

close=df["close"],

volume=df["volume"],

timeperiod=self.mfi_length,

)

- 50

)

df["atr"] = talib.ATR(

high=df["high"],

low=df["low"],

close=df["close"],

timeperiod=self.atr_length,

)

df["fast_ema"] = talib.EMA(df["close"], timeperiod=self.fast_ema_length)

df["slow_ema"] = talib.EMA(df["close"], timeperiod=self.slow_ema_length)

difference = df["wt2"] - df["wt1"]

cross = np.sign(difference.shift(1)) != np.sign(difference)

df["long_entry"] = (

(df["close"] > df["slow_ema"])

& (df["low"] < df["fast_ema"])

& (df["mfi"] > 0)

& (df["wt1"] < 0)

& cross

& (difference < 0)

)

df["short_entry"] = (

(df["close"] < df["slow_ema"])

& (df["low"] > df["fast_ema"])

& (df["mfi"] < 0)

& (df["wt1"] > 0)

& cross

& (difference > 0)

)

df["entry"] = df["long_entry"] | df["short_entry"]

return df

def on_entry(self, row: dict, session: Session):

if self.wallet.base != 0:

# keep only one session open

return

if row["long_entry"]:

session.position += quote(100)

session.stop_loss = row["close"] - row["atr"] * self.stop_loss_k

session.take_profit = row["close"] + row["atr"] * self.take_profit_k

else:

session.position -= quote(100)

session.stop_loss = row["close"] + row["atr"] * self.stop_loss_k

session.take_profit = row["close"] - row["atr"] * self.take_profit_k

def main():

cipher = Cipher()

cipher.add_source("gateio_spot_ohlc", symbol="DOGE_USDT", interval="1h")

cipher.set_strategy(VuManChuCipherBStrategy())

cipher.run(start_ts="2025-01-01", stop_ts="2025-04-01")

cipher.set_commission("0.00075")

cipher.plot(

rows=[

["ohlc", "slow_ema", "fast_ema", "sessions"],

["wt1", "wt2"],

["mfi"],

["position"],

["balance"],

]

)

if __name__ == "__main__":

main()

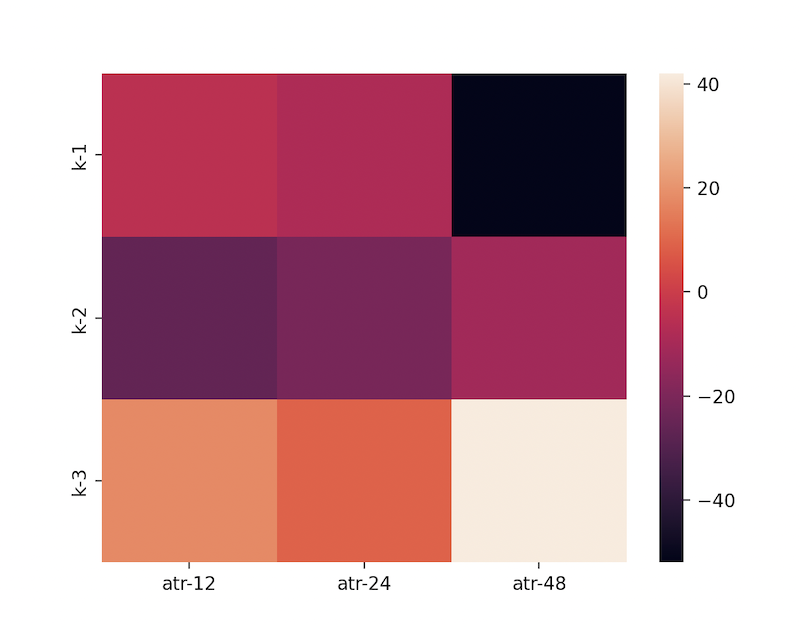

Parameters optimization

Let's try different atr lengths and take profit and stop loss multipliers:

import matplotlib.pyplot as plt

import seaborn as sns

from pandas import DataFrame

...

def main():

heat_map = DataFrame()

for atr_length in (12, 24, 48):

column = {}

for stop_loss_k in (1, 2, 3):

cipher = Cipher()

cipher.add_source("gateio_spot_ohlc", symbol="DOGE_USDT", interval="1h")

cipher.set_strategy(

VuManChuCipherBStrategy(

atr_length=atr_length,

stop_loss_k=stop_loss_k,

take_profit_k=stop_loss_k * 2,

)

)

cipher.run(start_ts="2025-01-01", stop_ts="2025-04-01")

cipher.set_commission("0.00075")

column[f"k-{stop_loss_k}"] = int(cipher.stats.romad * 100)

heat_map[f"atr-{atr_length}"] = column

sns.heatmap(heat_map)

plt.show()

ATR lengths = 48 and stop_loss_k = 3 shows the best result among tested.