Tutorial

This comprehensive tutorial demonstrates how to implement and test a Moving Average Convergence Divergence (MACD) trading strategy featuring ATR-based stop losses and a two-stage take profit system.

Strategy Overview:

- Entry Signal: MACD line crosses above signal line when both are below zero

- Stop Loss: Based on Average True Range (ATR) for dynamic risk management

- Take Profit: Two-stage system using ATR multiples for optimized exits

Original strategy source: Highly Profitable MACD Trading Strategy Proven 100 Trades (2 Stage Take Profit) on YouTube

Step 1: Creating the Strategy Template

Begin by creating a new strategy file:

cipher new macd

cat macd.py

This generates a basic strategy template:

from cipher import Cipher, Strategy

class MacdStrategy(Strategy):

pass

def main():

cipher = Cipher()

cipher.add_source("gateio_spot_ohlc", symbol="DOGE_USDT", interval="1h")

cipher.set_strategy(MacdStrategy())

cipher.run(start_ts="2020-01-01", stop_ts="2020-02-01")

print(cipher.sessions)

print(cipher.stats)

cipher.plot()

if __name__ == '__main__':

main()

Execute the initial backtest:

python macd.py

Step 2: Implementing Technical Indicators

Adding MACD and ATR Indicators

The strategy requires two key indicators:

- MACD: For trend identification and entry signals

- ATR: For dynamic stop loss and take profit levels

Interactive Development Approach

For experimentation, you can add a breakpoint in the compose method to test indicators interactively:

class MacdStrategy(Strategy):

def compose(self):

df = self.datas.df

breakpoint() # Interactive testing point

return df

Testing MACD Parameters

In the interactive session, test the MACD indicator:

talib.MACD(df.close, fastperiod=12, slowperiod=26, signalperiod=9)

# Returns: macd, macd signal, and macd histogram

To explore indicator parameters, use Python's help system:

import talib

help(talib.MACD)

Initial Indicator Implementation

class MacdStrategy(Strategy):

def compose(self):

df = self.datas.df

df["macd"], df["macds"], _ = talib.MACD(

df.close, fastperiod=12, slowperiod=26, signalperiod=9

)

return df

def main():

# ... existing code ...

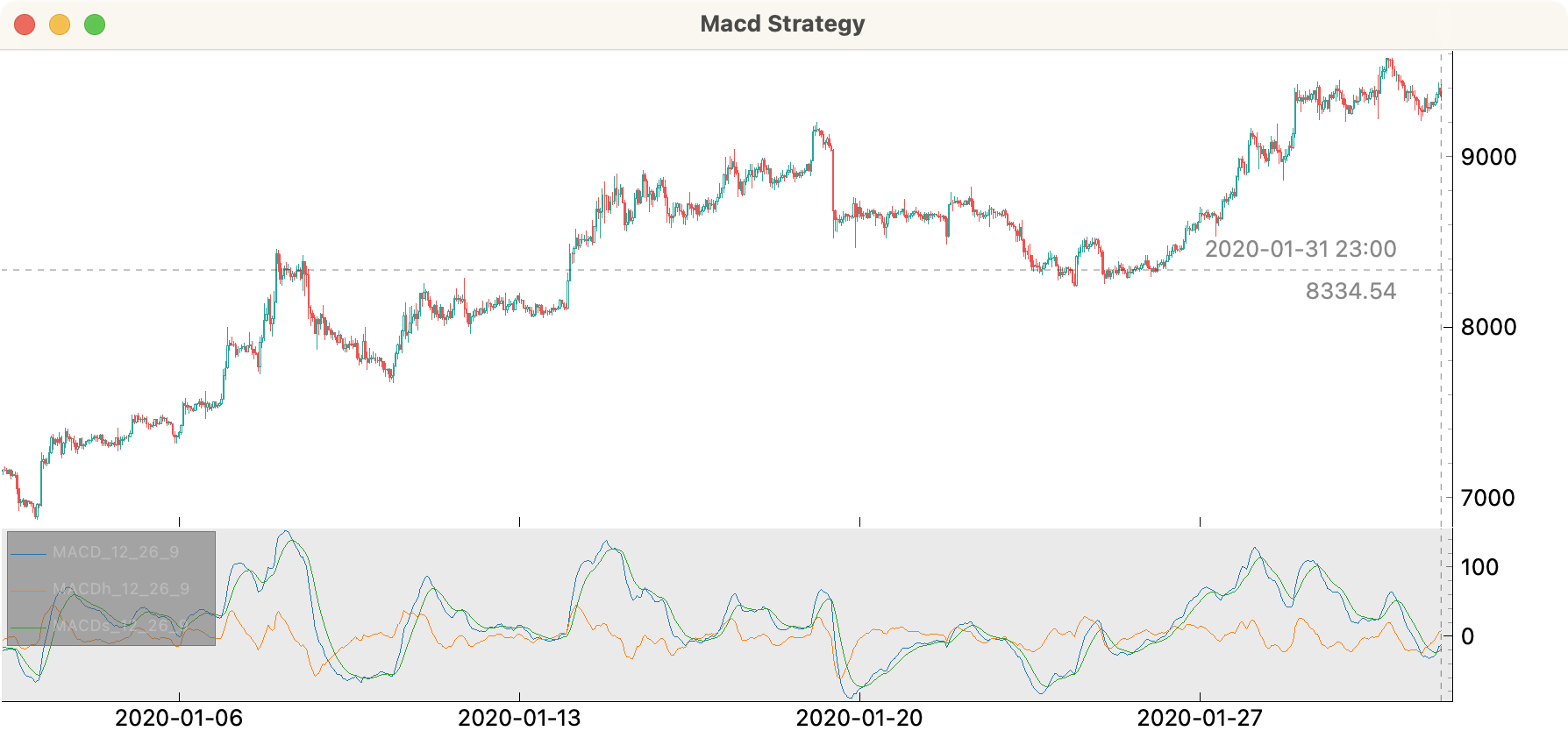

cipher.plot(rows=[["ohlc"], ["macd", "macds"]])

Refined Indicator Setup

For cleaner code and better performance, implement indicators directly with custom column names:

class MacdStrategy(Strategy):

def compose(self):

df = self.datas.df

# Calculate MACD components

df["macd"], df["macds"], _ = talib.MACD(

df.close, fastperiod=12, slowperiod=26, signalperiod=9

)

# Calculate Average True Range for volatility-based stops

df["atr"] = talib.ATR(df["high"], df["low"], df["close"], timeperiod=14)

return df

def main():

cipher = Cipher()

cipher.add_source("gateio_spot_ohlc", symbol="DOGE_USDT", interval="1h")

cipher.set_strategy(MacdStrategy())

cipher.run(start_ts="2020-01-01", stop_ts="2020-02-01")

cipher.plot(rows=[["ohlc"], ["macd", "macds"]])

Step 3: Generating Entry Signals

Signal Logic

The entry signal triggers when:

- MACD line crosses above the signal line (bullish crossover)

- Both MACD and signal line are below zero (oversold conditions)

class MacdStrategy(Strategy):

def compose(self):

df = self.datas.df

# Technical indicators

df["macd"], df["macds"], _ = talib.MACD(

df.close, fastperiod=12, slowperiod=26, signalperiod=9

)

df["atr"] = talib.ATR(df["high"], df["low"], df["close"], timeperiod=14)

# Entry signal generation

difference = df["macds"] - df["macd"]

cross = np.sign(difference.shift(1)) != np.sign(difference)

df["entry"] = cross & (difference < 0) & (df["macds"] < 0)

return df

def main():

cipher = Cipher()

cipher.add_source("gateio_spot_ohlc", symbol="DOGE_USDT", interval="1h")

cipher.set_strategy(MacdStrategy())

cipher.run(start_ts="2020-01-01", stop_ts="2020-02-01")

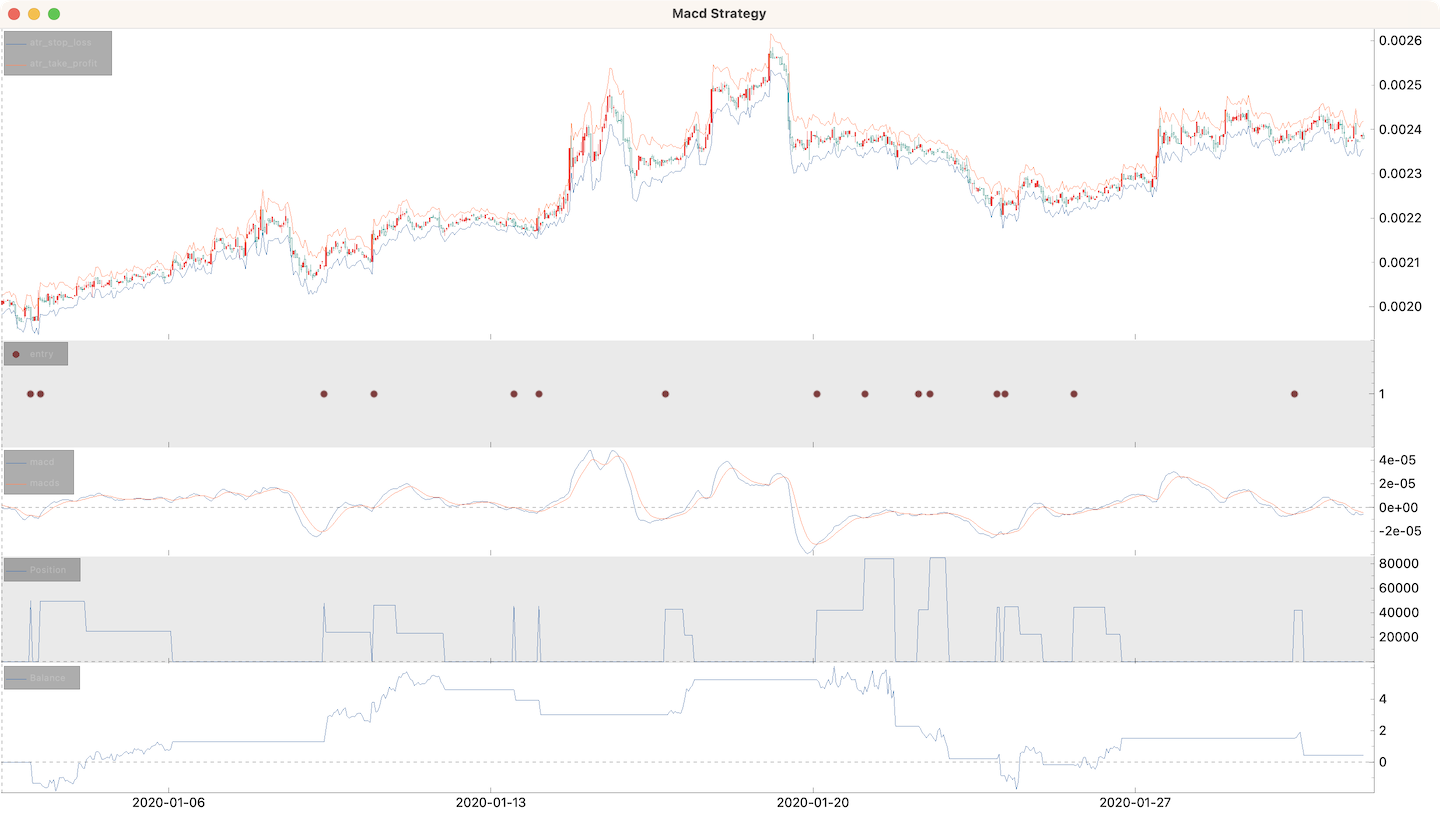

cipher.plot(rows=[["ohlc"], ["signals"], ["macd", "macds"]])

Step 4: Complete Strategy Implementation

Full Strategy with Risk Management

import numpy as np

import talib

from cipher import Cipher, Session, Strategy, quote

class MacdStrategy(Strategy):

def compose(self):

df = self.datas.df

# Technical indicators

df["macd"], df["macds"], _ = talib.MACD(

df.close, fastperiod=12, slowperiod=26, signalperiod=9

)

df["atr"] = talib.ATR(df["high"], df["low"], df["close"], timeperiod=14)

# Entry signal

difference = df["macds"] - df["macd"]

cross = np.sign(difference.shift(1)) != np.sign(difference)

df["entry"] = cross & (difference < 0) & (df["macds"] < 0)

# Risk management levels

df["atr_stop_loss"] = df["close"] - (df["atr"] * 1.5)

df["atr_take_profit"] = df["close"] + (df["atr"] * 1.5)

return df

def on_entry(self, row: dict, session: Session):

"""Execute entry logic with risk management setup"""

# Position sizing: $100 worth of the asset

session.position = quote(100)

# Set initial risk management levels

session.stop_loss = row["atr_stop_loss"]

session.take_profit = row["atr_take_profit"]

# Store second-stage targets

session.meta["next_take_profit"] = (

row["close"] + (row["atr_take_profit"] - row["close"]) * 2

)

session.meta["next_stop_loss"] = row["close"] # Breakeven stop

def on_take_profit(self, row: dict, session: Session):

"""Implement two-stage take profit system"""

if session.meta["next_take_profit"]:

# First take profit: reduce position by 50%

session.position *= 0.5

# Set second stage targets

session.take_profit = session.meta["next_take_profit"]

session.stop_loss = session.meta["next_stop_loss"] # Move to breakeven

# Clear second stage flag

session.meta["next_take_profit"] = None

else:

# Second take profit: close remaining position

session.position = 0

def main():

cipher = Cipher()

cipher.add_source("gateio_spot_ohlc", symbol="DOGE_USDT", interval="1h")

cipher.set_strategy(MacdStrategy())

cipher.run(start_ts="2025-01-01", stop_ts="2025-02-01")

# Comprehensive plotting

cipher.plot(

rows=[

["ohlc", "atr_stop_loss", "atr_take_profit"], # Price action with levels

["signals"], # Entry signals

["macd", "macds"], # MACD indicator

["position"], # Position size over time

["balance"], # Portfolio balance

]

)

# Performance analysis

print(cipher.sessions)

print(cipher.stats)

if __name__ == "__main__":

main()

Session Period PnL

--------------------- -------- ---------

long 2020-01-03 00:00 1h -1.35068

long 2020-01-03 05:00 2d 21h 2.65973

long 2020-01-09 09:00 1d 1h 2.51076

long 2020-01-10 11:00 1d 13h 0.787893

long 2020-01-13 12:00 1h -0.678198

long 2020-01-14 01:00 1h -0.916931

long 2020-01-16 19:00 15h 2.21554

long 2020-01-20 02:00 1d 17h -1.82047

long 2020-01-21 03:00 16h -1.11205

long 2020-01-22 07:00 15h -1.10829

long 2020-01-22 13:00 10h -0.977476

long 2020-01-24 00:00 2h -1.09632

long 2020-01-24 04:00 20h 0.706303

long 2020-01-25 16:00 1d 1h 1.70895

long 2020-01-30 11:00 5h -1.09761

---------------- --------------------- ------

start 2020-01-02 09:00

stop 2020-01-31 23:00

period 29d 14h

trades 15

longs 15 100.0%

shorts 0

period median 15h

period max 2d 21h

success 6 40.0%

success median 1.9622442059571628645

success max 2.659732540861812779

success row 3

failure 9 60.0%

failure median 1.097612065354000837

failure max 1.820469798657718121

failure row 5

spf 0.6666666666666666

pnl 0.431161233126911900

commission 0E-18

balance min -1.8459700380155368

balance max 6.108997031624028

balance drawdown 7.844823888438853

romad 0.054961238041599234

---------------- --------------------- ------

Exercise

- Try different symbols, intervals, date ranges

- Experiment with different MACD parameters (fast/slow/signal periods)

- Test alternative volatility measures for stop loss calculation

- Implement shorting

- Add market regime detection for adaptive strategy behavior